As the cryptocurrency landscape continues to evolve, savvy investors are looking for ways to optimize their mining investment portfolios. In 2025, the potential rewards for astute miners could reach unprecedented heights, especially with the ascension of Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE) challenging the traditional norms of finance. Scaling your mining investment portfolio requires a multifaceted approach, integrating advanced mining technologies and a deep understanding of market dynamics.

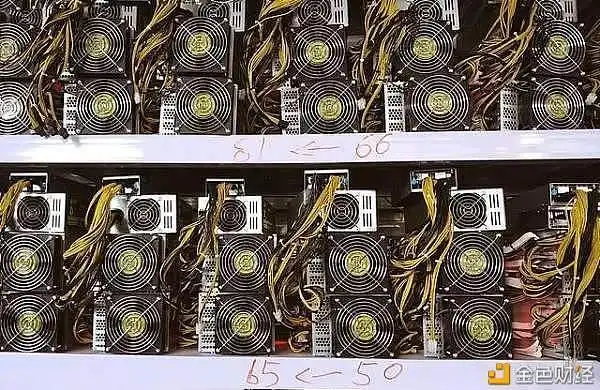

One of the pivotal elements in enhancing your mining investment strategy is the choice of mining machines. With a wide array of mining rigs available on the market, ranging from ASIC miners to GPU rigs, understanding their performance metrics is crucial. ASIC miners, specifically designed for Bitcoin mining, deliver unparalleled efficiency but can be costly upfront. In contrast, GPU rigs offer versatility, enabling miners to switch easily between different cryptocurrencies as per market trends. This adaptability can help you mitigate risks, allowing your investment to grow in the ever-fluctuating crypto landscape.

Hosting services can also significantly amplify your mining productivity. By utilizing mining machine hosting facilities, you can leverage state-of-the-art cooling systems and uninterrupted power supply to maximize your rig’s performance. This not only optimizes mining operations but also eliminates the headaches of managing equipment logistics. Furthermore, these hosting facilities often house high-end hardware which might be unaffordable for individual miners. Choosing a reputable host can thus enhance the efficiency of your mining rigs and provide a more consistent ROI, especially with the projected boom in cryptocurrency prices by 2025.

The significance of keeping abreast with crypto exchanges cannot be overstated. These platforms facilitate the buying and selling of your mined coins, making it imperative to understand their fee structures and liquidity conditions. A savvy approach involves monitoring multiple exchanges to seize opportunities when prices dip or peak. Developed strategies for trading mined currencies, such as setting stop losses or taking profits at predetermined levels, can provide a safety net, allowing you to scale your portfolio according to chosen risk profiles.

Moreover, understanding the nuances of cryptocurrency inflation and rewards systems can enhance your overall strategy. Bitcoin, for instance, has a halving event every four years, drastically reducing mining rewards and potentially leading to price surges in anticipation. Staying informed about such changes enables you to make precise adjustments to your portfolio, optimizing for maximum returns. On the other hand, Ethereum’s transition to a proof-of-stake model introduces new dynamics, suggesting that diversification into staking alongside traditional mining may provide additional benefits.

Furthermore, as the cryptocurrency sector matures, new prospects arise. Innovative blockchain technologies and decentralized finance (DeFi) projects could yield fruitful returns for forward-thinking investors. Exploring lesser-known cryptocurrencies with solid fundamentals and communities may enhance diversification. Assets like Polkadot (DOT) or Chainlink (LINK) warrant attention as they gain traction, representing cutting-edge technologies that could serve as complementary investments to your BTC, ETH, and DOGE holdings.

In essence, scaling your mining investment portfolio for greater rewards by 2025 hinges on a combination of strategic equipment acquisition, understanding market mechanics, utilizing hosting capabilities, and diversifying into promising new assets. The world of cryptocurrency is teeming with opportunities for those willing to adapt and innovate. As digital currencies continue to fuse into the fabric of our financial systems, your mining strategy deserves an equally dynamic approach.

This savvy guide on scaling mining investments for 2025 rewards mixes bold strategies with timely warnings, like a high-stakes treasure hunt—diversify wisely or risk mining fool’s gold in volatile markets!